Mark Manson’s book, Everything is F*cked, introduced me to an essential concept of the human condition: the Blue Dot Effect.

In a set of experiments led by Daniel Gilbert, a Harvard psychologist, and his student David Levari, researchers found that when a problem becomes less common, people tend to broaden their definition of the problem.

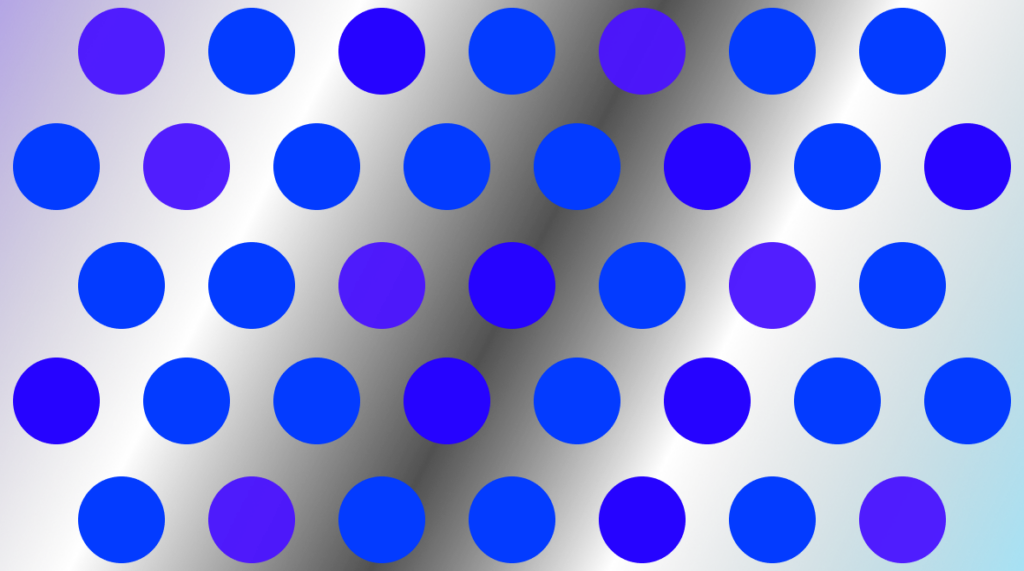

They asked volunteers to identify blue dots on a screen among blue and purple ones. As the experiment progressed, they reduced the number of blue dots on the screen and replaced them with various shades of purple. However, the shocking result was that volunteers started calling purple dots as blue.

Even when warned about the increase in purple dots and offered money not to do so, they still made the same mistake. Their vision had been distorted.

According to the researchers, it could be that the human brain doesn’t make decisions based on cold, hard rules, but rather on prior stimuli. As the balance of blue-to-purple dots shifted, the participants expanded their definition of what “blue” really looked like in order to match the expectations formed from the earlier trials.

What does this actually mean?

● The blue dot effect narrows our perception and makes us view life through a distorted perspective. This changes our relationship to progress and makes us victims to our own lives.

● A distorted vision creates biases on your ability to make logical decisions.

● This tendency extends beyond dots on a screen to real-life situations, where people may perceive more threats and insecurities than actually exist.

How does this theory control your life? ( and your decision making abilities)

● If you drive a BMW and you see a Rolls Royce, you feel the need to compare your progress and see how much you still need to improve, instead of seeing how far you’ve actually come.

● If you started going to the gym this year and you have been consistent with your health plan thus far, it is unfair to compare your body to the person who started many years ago.

● If your portfolio returns are 18%, but your brother-in-law’s portfolio is yielding 24% this year, it does not mean that your phenomenal 18% annualized growth in wealth is meaningless.

The Blue Dot Effect suggests that we’re naturally inclined towards pessimism. We often ignore that the progress is always slow, small and trivial. We also forget that this small progress today will likely lead to better ideas and life tomorrow.

Being aware of the blue dot effect in the world of real estate investing:

★ Acknowledge that pessimism is an essential element in progress. However, a continual pessimistic approach may lead to missed investment opportunities.

★ The Blue Dot Effect applies to human investment behavior by highlighting our tendency to focus on short-term negative news or market fluctuations rather than the long-term progress of investments.

★ Set your investment yields, your cash flow targets and your personal expectations. Meeting those goals of financial freedom is a moment of celebration of progress, not a moment of comparison.

Stay healthy, Do happy, Excelsior!