Want to shortcut your way to real estate riches? Gary Keller’s “The Millionaire Real Estate Investor” is your cheat code. Forget abstract theories; this book pulls back the curtain on how real-life millionaires built their fortunes, offering a tangible roadmap for your own journey. Here’s a breakdown of the five core principles that can transform your investing approach: 1. Clone Success, Not Start From Scratch: Imagine having a mentor who’s already walked the path to real estate wealth. That’s what Keller offers. He emphasizes the power of modeling success. It’s not about blindly copying, but about dissecting the strategies of those who’ve made it. Think of it as finding the hidden patterns, the “clues,” that led to their achievements. By studying their methods, you can build a customized strategy that avoids common pitfalls and accelerates your own growth. Think of it as having a coach—a mentor—guiding your every move. 2. Your Net Worth: The Scoreboard of Success: Building wealth isn’t a guessing game. Keller stresses the importance of tracking your net worth—your financial scorecard. This means understanding the difference between your assets (what you own) and liabilities (what you owe). Your net worth, or equity, is the “golden goose” that lays the “golden eggs” of cash flow. Regular monitoring keeps you laser-focused on your goals, allowing you to make strategic adjustments along the way. 3. Fueling Your Wealth Engine: Equity and Cash Flow: Keller simplifies the complex world of real estate wealth into two fundamental engines: equity and cash flow. Equity builds through debt paydown, property appreciation (both natural and forced), while cash flow is driven by increasing rents and paying off mortgages. Mastering both engines is crucial for long-term financial success. Think of them as the two gears that propel your wealth machine. 4. The CTN Framework: Your Investing GPS: Navigating the real estate landscape requires a clear strategy. Keller introduces the CTN model: Criteria, Terms, and Network. Define your ideal property criteria, master deal analysis and negotiation (“terms”), and build a powerful team (“network”). This framework provides a practical guide for identifying and securing lucrative deals. Remember, real estate is a team sport; you need the right players on your side. 5. The Patient Shopper: Your Competitive Edge: In the fast-paced world of real estate, discipline and patience are your superpowers. Keller advises adopting the mindset of a “shopper,” not a “buyer.” This means constantly exploring opportunities but only acting when the perfect deal aligns with your criteria. Avoid the herd mentality, stick to your guns, and remember that real estate is a long game. There will always be more opportunities. Keller’s book is more than just a guide; it’s a blueprint for building a lasting real estate legacy. By embracing these five principles, you can transform your investing approach, navigate the market with confidence, and ultimately achieve your financial dreams. As per Freddie Mac, 2025 may present the best opportunities for multifamily investing. Are you prepared?

AIMI: Your Guide to Understanding the Multifamily Investment Landscape

What is AIMI? Created by Freddie Mac, AIMI (Apartment Market Investment Index) is a valuable tool designed specifically for the multifamily market. It combines key indicators to provide a unique snapshot of investment conditions across the United States and in major markets. How Does AIMI Work? At its core, AIMI compares rental income, the lifeblood of your investment, to the overall cost of investment. It factors in two crucial elements: By analyzing these factors, AIMI reveals how investment conditions are evolving over time. Learning from AIMI’s Insights Take the example of Dallas leading up to the Great Recession: AIMI started dropping in 2004. This signaled a warning sign. Why? These factors combined meant that while rental income remained stagnant, the cost of investment was rising – a red flag for potential investors. The good news is that AIMI can also identify opportunities. During and after the recession, AIMI rose. This indicated an improving investment environment. Why? Property values fell faster than income, making investments more affordable per dollar of rental income. AIMI in the Modern Market Post-recession, AIMI stabilized for a while as income grew steadily and mortgage rates declined. However, since 2016, it’s been trending downward. This suggests less favorable conditions due to high property price growth outpacing even strong income growth. However, a ray of hope emerged in 2019. A significant drop in mortgage rates caused AIMI to rise. This is because lower interest rates translate to a lower cost of capital for investors. The Power of Historical Comparison AIMI allows you to compare historical values. For instance, the AIMI value in 2019 was similar to 2010. While the underlying factors used to calculate AIMI might differ, the index result paints a similar picture of market conditions. The Final Word While investors consider a variety of factors when making decisions, AIMI offers a powerful tool to analyze market trends and understand the overall investment environment. It also provides a sensitivity table, allowing you to see how variations in key drivers can impact the index value. So, the next time you’re considering a multifamily investment, be sure to check out AIMI. It can be your quick and valuable guide to navigating the ever-changing multifamily market landscape. Stay informed. Stay empowered. Stay with Liberty Capitus. What’s your financial growth plan? If it’s not apartment investing, listen up.

Multifamily Landscape 2025

The multifamily market is navigating a complex landscape in 2025, characterized by a confluence of factors that are shaping its trajectory. While positive rent growth is anticipated, it’s expected to fall short of historical averages, a trend mirrored by a modest increase in vacancy rates. WHY? – This dynamic is largely attributed to a surge in new supply, particularly concentrated in the Sun Belt and Mountain West regions, which is exerting downward pressure on rent growth and occupancy rates in these areas. Conversely, markets with lower supply levels and less aggressive rent growth since the pandemic are poised to outperform. Furthermore, the elevated and volatile interest rate environment continues to cast a shadow over the market. While transaction volume is projected to increase, the impact of higher borrowing costs on property values and investor returns remains a significant concern. Despite these challenges, the multifamily housing market remains attractive because there’s a continuous housing shortage, strong home sales, and favorable demographic trends driving demand for rental housing. This newsletter delves deeper into these key market drivers, providing insights into regional performance, investor sentiment, and the outlook for the remainder of 2025. Key Market Drivers: Regional Performance: Transaction Activity: Long-Term Outlook: Despite short-term challenges, the long-term outlook for the multifamily market remains positive. Stay informed. Stay empowered. Stay with Liberty Capitus. What’s your financial growth plan?

Mastering Real Estate Investing: 5 Secrets from Keller’s Millionaire Blueprint

Want to shortcut your way to real estate riches? Gary Keller’s “The Millionaire Real Estate Investor” is your cheat code. Forget abstract theories; this book pulls back the curtain on how real-life millionaires built their fortunes, offering a tangible roadmap for your own journey. Here’s a breakdown of the five core principles that can transform your investing approach: 1. Clone Success, Not Start From Scratch: Imagine having a mentor who’s already walked the path to real estate wealth. That’s what Keller offers. He emphasizes the power of modeling success. It’s not about blindly copying, but about dissecting the strategies of those who’ve made it. Think of it as finding the hidden patterns, the “clues,” that led to their achievements. By studying their methods, you can build a customized strategy that avoids common pitfalls and accelerates your own growth. Think of it as having a coach—a mentor—guiding your every move. 2. Your Net Worth: The Scoreboard of Success: Building wealth isn’t a guessing game. Keller stresses the importance of tracking your net worth—your financial scorecard. This means understanding the difference between your assets (what you own) and liabilities (what you owe). Your net worth, or equity, is the “golden goose” that lays the “golden eggs” of cash flow. Regular monitoring keeps you laser-focused on your goals, allowing you to make strategic adjustments along the way. 3. Fueling Your Wealth Engine: Equity and Cash Flow: Keller simplifies the complex world of real estate wealth into two fundamental engines: equity and cash flow. Equity builds through debt paydown, property appreciation (both natural and forced), while cash flow is driven by increasing rents and paying off mortgages. Mastering both engines is crucial for long-term financial success. Think of them as the two gears that propel your wealth machine. 4. The CTN Framework: Your Investing GPS: Navigating the real estate landscape requires a clear strategy. Keller introduces the CTN model: Criteria, Terms, and Network. Define your ideal property criteria, master deal analysis and negotiation (“terms”), and build a powerful team (“network”). This framework provides a practical guide for identifying and securing lucrative deals. Remember, real estate is a team sport; you need the right players on your side. 5. The Patient Shopper: Your Competitive Edge: In the fast-paced world of real estate, discipline and patience are your superpowers. Keller advises adopting the mindset of a “shopper,” not a “buyer.” This means constantly exploring opportunities but only acting when the perfect deal aligns with your criteria. Avoid the herd mentality, stick to your guns, and remember that real estate is a long game. There will always be more opportunities. Keller’s book is more than just a guide; it’s a blueprint for building a lasting real estate legacy. By embracing these five principles, you can transform your investing approach, navigate the market with confidence, and ultimately achieve your financial dreams. As per Freddie Mac, 2025 may present the best opportunities for multifamily investing. Are you prepared? For more resources and assistance, sign up for our latest webinar on our website. 📩 DISCLOSURES: Any performance data shared by Liberty Capitus represents past performance and past performance does not guarantee future results. Neither Liberty Capitus nor any of its projects are required by law to follow any standard methodology when calculating and representing performance data and the performance of any such projects may not be directly comparable to the performance of other private or registered projects. This summary is not intended to be a general solicitation or a securities offering of any kind. Prior to making any decision to contribute capital, all investors must review and execute all private offering documents, including the Private Placement Memorandum and its exhibits, which contains the complete information about the investment opportunity. The information contained herein is from sources believed to be reliable, however no representation by Sponsors, either expressed or implied, is made as to the accuracy of any information on this property and all investors should conduct their own research to determine the accuracy of any statements made. None of the information provided should be seen or considered as tax or legal advice or services. Please consult a licensed or registered professional. This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

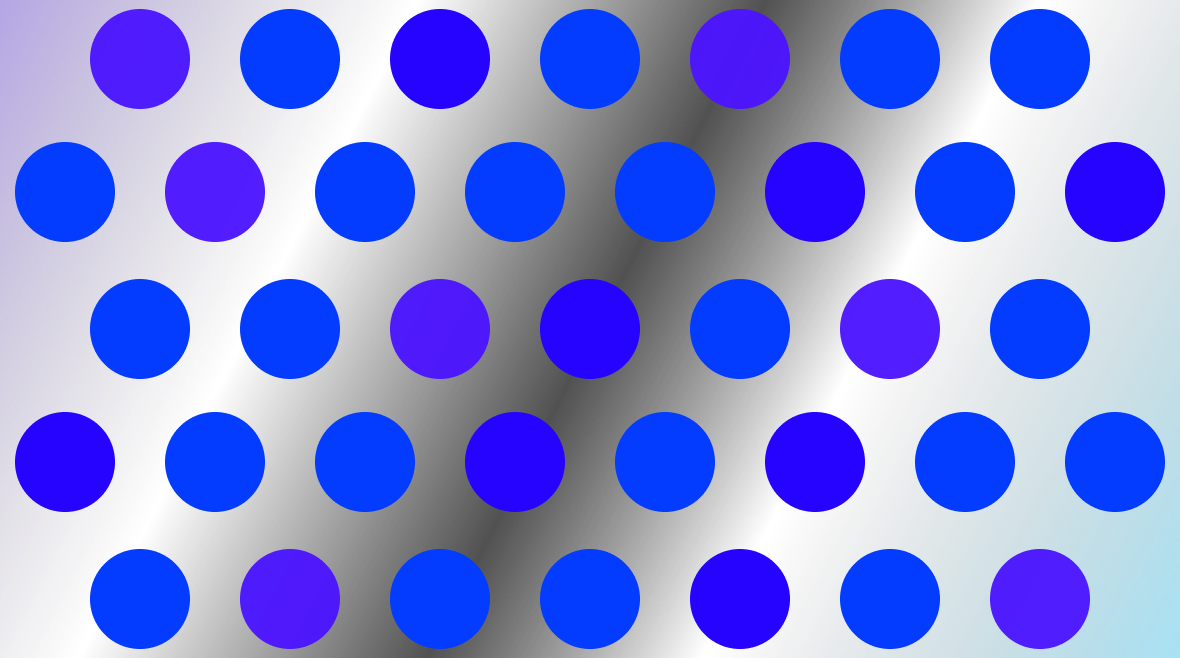

The Blue Dot Effect [A Harvard Study] … and how it’s secretly affecting your investment decisions

Mark Manson’s book, Everything is F*cked, introduced me to an essential concept of the human condition: the Blue Dot Effect. In a set of experiments led by Daniel Gilbert, a Harvard psychologist, and his student David Levari, researchers found that when a problem becomes less common, people tend to broaden their definition of the problem. They asked volunteers to identify blue dots on a screen among blue and purple ones. As the experiment progressed, they reduced the number of blue dots on the screen and replaced them with various shades of purple. However, the shocking result was that volunteers started calling purple dots as blue. Even when warned about the increase in purple dots and offered money not to do so, they still made the same mistake. Their vision had been distorted. According to the researchers, it could be that the human brain doesn’t make decisions based on cold, hard rules, but rather on prior stimuli. As the balance of blue-to-purple dots shifted, the participants expanded their definition of what “blue” really looked like in order to match the expectations formed from the earlier trials. What does this actually mean? ● The blue dot effect narrows our perception and makes us view life through a distorted perspective. This changes our relationship to progress and makes us victims to our own lives. ● A distorted vision creates biases on your ability to make logical decisions. ● This tendency extends beyond dots on a screen to real-life situations, where people may perceive more threats and insecurities than actually exist. How does this theory control your life? ( and your decision making abilities) ● If you drive a BMW and you see a Rolls Royce, you feel the need to compare your progress and see how much you still need to improve, instead of seeing how far you’ve actually come. ● If you started going to the gym this year and you have been consistent with your health plan thus far, it is unfair to compare your body to the person who started many years ago. ● If your portfolio returns are 18%, but your brother-in-law’s portfolio is yielding 24% this year, it does not mean that your phenomenal 18% annualized growth in wealth is meaningless. The Blue Dot Effect suggests that we’re naturally inclined towards pessimism. We often ignore that the progress is always slow, small and trivial. We also forget that this small progress today will likely lead to better ideas and life tomorrow. Being aware of the blue dot effect in the world of real estate investing: ★ Acknowledge that pessimism is an essential element in progress. However, a continual pessimistic approach may lead to missed investment opportunities. ★ The Blue Dot Effect applies to human investment behavior by highlighting our tendency to focus on short-term negative news or market fluctuations rather than the long-term progress of investments. ★ Set your investment yields, your cash flow targets and your personal expectations. Meeting those goals of financial freedom is a moment of celebration of progress, not a moment of comparison. Stay healthy, Do happy, Excelsior!

Life, Liberty, and Real Estate

Welcome to “Life, Liberty, and Real Estate” Newsletter! ✨ Do you know that your relationship with money subconsciously drives your investment decisions? In the hustle and bustle of our daily lives, the decisions we make regarding personal finance, investments, spending and the pursuit of freedom shape our destinies. Investing is not just about creating higher than average returns, or beating the market, or finding a smoking hot real estate deal. Investing is more than just creating ROIs or watching KPIs. Investing is about creating a holistic approach towards life. I am thrilled to introduce you to a bi-weekly journey that explores the intersections of life, liberty, and the ever-evolving world of real estate. In the hustle and bustle of our daily lives, the decisions we make regarding personal finance, our living spaces, and the pursuit of freedom shape our destinies. Why “Life, Liberty, and Real Estate”? 🌐 Life: Uncover tips and strategies to enhance your overall well-being, both personally and financially. We will talk about money and the psychology of investing. I will share my perspective as a parent, husband, son, brother, friend and relationships. From managing investments to achieving a work-life balance, spirituality and awareness, we’re committed to empowering you on your journey called Life. 🗽 Liberty: Dive into discussions on financial freedom, location independence, and the pursuit of a life that aligns with your values. Discover how real estate can be a key player in unlocking new levels of liberty and autonomy. Because money buys more than just financial freedom. 🏠 Real Estate: Of course, my favorite topic in the world. I will share my perspectives and insights on why real estate investing. Whether you’re a seasoned investor or a first-time homebuyer, we’ve got you covered. What to Expect: Every other week we will dive into a different compelling topic and analyze it for insights about money, life, and investing that we think you’re going to love! I promise you that the spectrum of topics will be wide and thought provoking. If you’re ready to embark on this adventure, hit that “Subscribe” button to stay updated with the latest insights. Here’s to a life filled with liberty and thriving in the world of real estate! Letter #1: Why I believe that beating S&P 500 (or any other index) has no meaning in real life! 💥 “If you want a recipe for unhappiness, spend your time accumulating a lot of money and let your health and relationships deteriorate.”-James Clear Pretend you live in some magic fantasy world where all of your dreams (according to the investment industry) come true, and you actually beat an index every quarter for your whole life. Congratulations! Let me just be clear about something: It’s still possible, even under that fantasy scenario, that you don’t meet any of your financial goals or witness the meaningful milestones in life. Because beating an index has nothing to do with meeting your personal financial goals! Beating an index does not provide passive income. So here’s my question: You landed in Shangri La, according to the financial industry. You beat the index. But you didn’t meet your goals. Are you happy? The answer is, “No.” 🚫 Winning the index game does not provide any passive income or create any meaningful impact in current life. Winning the index does not have tax advantages. Now let’s flip that scenario on its head. The worst thing in the world happens to you (again, according to the investment industry). But because of consistent real estate investments, you meet your financial goals of passive income that creates more time in your present life. Let me repeat the question: Are you happy? And the answer is obviously… “Yes.” ✔️ Stop worrying about beating indexes. Focus instead on meeting your passive income goals. Passive CASH FLOW > Beating an Index !

Unlocking the Door to Multifamily Wealth: How Syndications Level the Playing Field

Multifamily real estate has long been a favored asset class for wealthy investors, generating substantial passive income and building long-term wealth. But how do they access these lucrative deals? One powerful strategy is syndication, and the great news is, you don’t have to be ultra-wealthy to participate. What is a Multifamily Syndication? In simple terms, it’s a group investment where multiple investors pool their capital together to purchase a larger multifamily property. The deal is led by a sponsor or syndicator who manages the acquisition, renovation (if applicable), and ongoing management of the property. How the Wealthy Leverage Syndications Wealthy investors understand the power of syndications: How You Can Get Involved You don’t need millions to invest in multifamily syndications. Here’s how: The Benefits of Syndication for You Conclusion Multifamily syndications are a powerful tool for investors of all levels to participate in the lucrative world of multifamily real estate. By leveraging the expertise of sponsors and pooling resources with other investors, you can unlock opportunities that were once reserved for the wealthy. Remember, do your research, build relationships, and start small. The world of multifamily investing is waiting for you!

Why Investing Out of State Is The Smartest Move You As An Investor Can Make

Real estate investing has long been considered a path to financial security, but in today’s competitive market, securing profitable deals close to home may prove challenging. This has led many savvy investors to cast a wider net, exploring opportunities beyond their local markets. While venturing into out-of-state investing may seem daunting, it can unlock a host of benefits that outweigh the risks for those willing to embrace a broader perspective. 1. Diversification and Risk Mitigation: One of the cardinal rules of investing is diversification, and real estate is no exception. Investing in properties across different geographical regions can help spread your risk. If one market experiences a downturn, your investments in other, more robust markets can offset potential losses, safeguarding your overall portfolio. 2. Access to Higher Returns: Different states experience varying levels of economic growth, population trends, and real estate market dynamics. Some states may offer higher potential for appreciation, rental yields, or both, compared to your local market. By investing out of state, you gain access to these potentially more lucrative opportunities, maximizing your returns. 3. Tap into Growing Markets: Emerging markets present a unique opportunity for investors seeking higher growth potential. Identifying and investing in up-and-coming areas can yield significant returns as these markets mature and property values appreciate. Out-of-state investing allows you to tap into such markets that may not be readily apparent in your local area. 4. Favorable Tax Environments: Some states offer more favorable tax structures for real estate investors, potentially increasing your net returns. Property taxes, income taxes, and other regulations can vary significantly from state to state. Careful research can reveal locations that offer tax advantages for real estate investments. 5. Reduced Competition: In saturated markets, competition for desirable properties can be fierce, driving up prices and reducing profit margins. Investing out of state may lead you to areas with less competition, allowing you to secure deals at more attractive prices and negotiate more favorable terms. 6. Expand Your Network: Out-of-state investing necessitates building relationships with professionals in new markets. This can expand your network of real estate agents, property managers, contractors, and other investors, opening doors to future opportunities and collaborations. 7. Gain Expertise in Multiple Markets: As you navigate different markets, you will gain valuable experience and insights into their specific characteristics and trends. This expanded knowledge base can make you a more versatile and adaptable investor, equipped to capitalize on diverse opportunities. 8. Leverage Technology and Remote Management: Technological advancements have made it easier than ever to manage properties remotely. Virtual tours, online rent collection platforms, and remote property management services enable you to effectively oversee your investments from afar, minimizing the challenges of geographic distance. Conclusion While venturing into out-of-state real estate investing requires careful due diligence and research, the potential rewards are substantial. Diversification, access to higher returns, and the ability to tap into emerging markets make it an appealing strategy for investors seeking to build a robust and profitable portfolio. Embracing technology and remote management can further streamline the process, making out-of-state investing a smart move for savvy real estate investors.

How to Select a Target Market for Real Estate Investment

Selecting the right target market is a critical first step in successful multifamily real estate investing. A well-chosen market can significantly impact your investment’s profitability and long-term success. Here’s a comprehensive guide on how to select a target market: 1. Economic Fundamentals: Population Growth: Look for markets with a growing population. This indicates a potential increase in demand for rental housing. Job Market: A strong job market with diverse industries and low unemployment rates creates stability and attracts new residents. Economic Diversity: Avoid markets heavily reliant on a single industry. Diversification offers protection against economic downturns in any one sector. Income Levels: Consider the average household income in the area. It should support the rental rates you need to achieve your investment goals. 2. Real Estate Market Dynamics: Supply and Demand: A healthy market has a balanced supply and demand for rental housing. Too much supply can lead to lower occupancy rates and rents. Property Values: Analyze historical and current property values to understand appreciation potential and market stability. Rental Rates: Research prevailing rental rates for comparable properties to ensure your investment can generate sufficient cash flow. Vacancy Rates: Low vacancy rates indicate strong demand for rental housing in the market. 3. Infrastructure and Amenities: Transportation: Proximity to major highways, public transportation, and airports can make a location more desirable to renters. Schools: Good schools are a major draw for families, especially in suburban areas. Amenities: Parks, shopping centers, restaurants, and entertainment options enhance the quality of life and attract renters. Future Development: Research any planned infrastructure or development projects that could positively impact property values in the future. 4. Regulatory and Tax Environment: Property Taxes: Research property tax rates and how they impact your investment’s profitability. Landlord-Tenant Laws: Familiarize yourself with the local landlord-tenant laws to understand your rights and responsibilities as a property owner. Zoning and Building Codes: Ensure the zoning and building codes support your investment plans, especially if you intend to make renovations or additions. 5. Personal Factors: Risk Tolerance: Assess your comfort level with risk. Some markets offer higher potential returns but may also carry higher risks. Investment Goals: Align your target market selection with your investment objectives, whether it’s cash flow, long-term appreciation, or a combination of both. Market Familiarity: Consider investing in markets you’re familiar with or willing to learn about extensively. Additional Tips: Conduct Thorough Research: Utilize online resources, real estate market reports, and professional advice to gather information on different markets. Visit Potential Markets: If possible, visit the areas you’re considering to get a feel for the neighborhoods and the overall real estate market. Network with Local Professionals: Connect with local real estate agents, property managers, and other investors to gain valuable insights. Start Small: If you’re new to out-of-state investing, consider starting with a smaller investment to gain experience and build confidence. Selecting the right target market requires careful analysis and due diligence. By considering economic fundamentals, real estate market dynamics, infrastructure, regulatory factors, and personal preferences, you can make informed decisions and increase your chances of success in multifamily real estate investing. Remember, investing in real estate involves risk. Past performance doesn’t guarantee future results, and it’s essential to conduct thorough research and seek professional advice before making any investment decisions.

Multifamily Passive Investor FAQs Answered

1. What is passive investing in multifamily real estate? Passive investing in multifamily real estate involves investing your capital with a group or syndication that acquires, manages, and operates multifamily properties. As a passive investor, you’re a limited partner (LP), contributing funds but not actively involved in the day-to-day operations. You benefit from cash flow generated by rental income and potential property appreciation upon sale. 2. What are the advantages of passive investing in multifamily? Passive income: Earn regular income without actively managing the property. Diversification: Spread your investment across multiple units and potentially different markets. Expertise: Leverage the experience and knowledge of the syndicator or property management team. Access to larger deals: Invest in larger, institutional-grade properties that would be out of reach for individual investors. Potential tax benefits: Depending on the investment structure, you may enjoy certain tax advantages. 3. How do I find multifamily syndications to invest in? Networking: Connect with experienced real estate investors and syndicators at industry events or online communities. Online platforms: Several online platforms specialize in connecting passive investors with multifamily syndications. Referrals: Seek recommendations from trusted financial advisors, real estate professionals, or other investors. 4. What are the risks associated with passive multifamily investing? Market risk: Property values and rental income can fluctuate based on market conditions. Sponsor risk: The success of the investment depends on the syndicator’s expertise and ability to manage the property effectively. Liquidity risk: Your investment is typically illiquid, meaning you cannot easily access your capital until the property is sold or refinanced. Fees: Syndicators typically charge fees for their services, which can impact your returns. 5. What due diligence should I perform before investing? Thoroughly research the syndicator: Review their track record, experience, and financial stability. Evaluate the investment property: Analyze the location, condition, financials, and market potential. Review the offering documents: Carefully read the Private Placement Memorandum (PPM) and other legal documents to understand the terms, fees, and risks associated with the investment. Seek professional advice: Consult with a financial advisor or real estate attorney to ensure the investment aligns with your financial goals and risk tolerance. 6. How can I ensure I’m choosing a reputable syndicator? Track record: Look for a syndicator with a proven track record of successful multifamily investments. Experience: Ensure the syndicator has extensive experience in the multifamily market, particularly in the target location. Transparency: Choose a syndicator who provides clear and transparent communication throughout the investment process. References: Ask for references from other investors who have worked with the syndicator. 7. What are the typical returns for passive multifamily investors? Returns vary depending on the specific investment, market conditions, and syndicator’s strategy. However, passive investors can expect to earn annual returns ranging from 8% to 12% or higher through a combination of cash flow distributions and potential property appreciation. Remember: Passive multifamily investing can be a powerful way to build wealth, but it’s essential to conduct thorough research and due diligence before committing your capital. Partnering with a reputable syndicator and choosing the right investment opportunity can significantly increase your chances of success. Always consult with a financial advisor to ensure that passive multifamily investing aligns with your overall financial goals and risk tolerance.