Built on trust,

Fueled by passion

investment through strong asset management and genuine meaningful relationships.

Long term vision, One relationship at a time, One investment at a time.

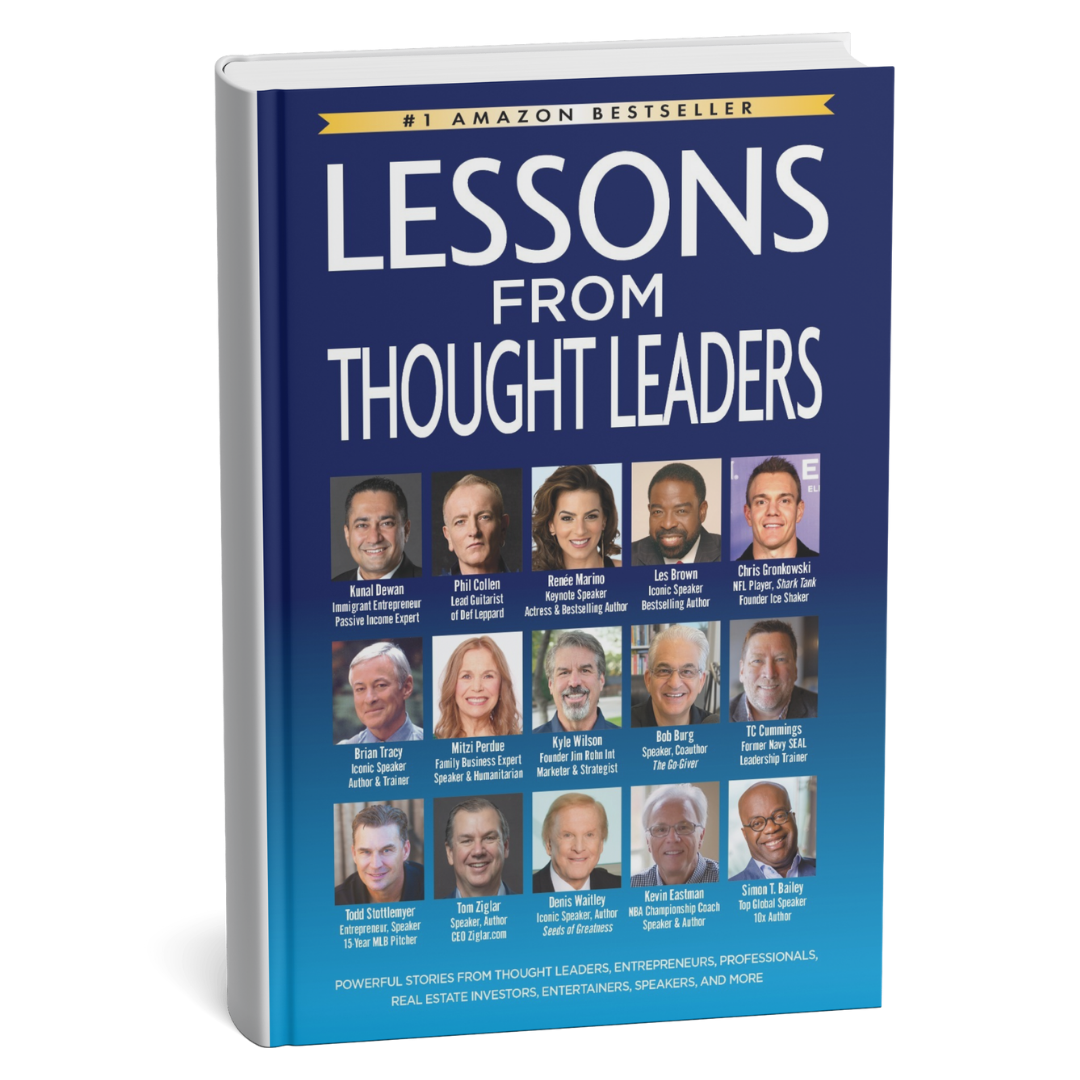

Unleash Your Potential with "Lessons From Thought Leaders"

Dive deep into the wisdom of some of the world’s most inspiring individuals in “Lessons From Thought Leaders.” This powerful collection of insights and advice features contributions from renowned figures like Brian Tracy, Phil Collen, Les Brown, Bob Burg, and many more.

As a co-author, I am incredibly honored to share this stage with such an esteemed group of entrepreneurs, professionals, and thought leaders.

Why Apartment Investing

Cash Flow

One of the biggest benefits of real estate investing is cash flow. You receive passive income on a monthly/quarterly basis without having to trade your time for money.

Leverage

You get to leverage our team’s operational and market expertise so you can easily diversify into more markets and asset classes without having to manage them yourself.

Equity

The beauty of cash flowing real estate is that the rental income covers the debt and expenses, meaning the tenants are helping you build equity.

Tax Benefits

Reduce, defer, or eliminate taxes on the profits from real estate investments. You want to keep more of what you make.

Appreciation

Because we are value add investors in multiple strategic markets, you can benefit from forced appreciation which helps you maximize your returns.

Sign up for our complimentary Webinar

Liberty Capitus Makes Real Estate Simple, Passive, and Profitable. To learn more, sign up for our complimentary webinar.

What Our Investors Have to Say

How We Select Our Markets

1

Rent Growth

The 5 year rent growth forecast is one of our key indicators. We use a powerful proprietary method to calculate this value.

2

Employment

We look for metros and submarkets that are adding a significant number of high-paying jobs, resulting in a stable local economy.

3

Sales Trends

We look for metros and submarkets that are adding a significant number of high-paying jobs, resulting in a stable local economy.

4

Supply & Demand

We monitor the supply of local units carefully to ensure it will not spike the vacancy rates and negatively impact rents.

Target Markets

Frequently Asked Questions (FAQs)

Real estate syndication brings the power of group buying to the world of real estate investing. A group of individual investors can invest in bigger, more valuable properties than each person could afford alone. Syndication is an effective way for a group of investors to pool their financial resources and make smart investments. Multifamily commercial properties like apartment complexes and condo communities are some of the most profitable projects for real estate syndicates.

Any investment carries risk. While we cannot guarantee anything, real estate—and in particular, multifamily real estate syndication—has proven to be among the safest investments available. Remember: rent keeps rising. Our process of uncovering devalued assets and turning them into desirable ones is a proven one. And we also invest right alongside our investors.

Multifamily housing has a variety of benefits for investors, including predictable returns, single-asset ownership, and significant tax savings. Real estate is very stable compared to the equities market. Workforce housing is undersupplied around the country with very little new stock in the development pipeline, and demand is increasing.

$50,000 for many syndications, but minimums may vary based on need and other circumstances.

Investor Insights

- All Posts

- Affordable Housing

- Financial Freedom

- Investing Insights

- Investor Education

- Life by Design

- Multifamily Investing

- Passive Investing

- Property Management

- Real Estate Investing 101

- Section 8

- Videos

Want to shortcut your way to real estate riches? Gary Keller’s “The Millionaire Real Estate Investor” is your cheat code. Forget abstract theories; this book...

The apartment market is cruising into a new phase. After a scorching run-up in rents, the national pace is expected to settle in 2024, with...

What is AIMI? Created by Freddie Mac, AIMI (Apartment Market Investment Index) is a valuable tool designed specifically for the multifamily market. It combines key...

The multifamily market is at a crossroads. While demand remains robust, a surge in new supply is creating headwinds, impacting rent growth and occupancy. As...

The multifamily market is navigating a complex landscape in 2025, characterized by a confluence of factors that are shaping its trajectory. While positive rent growth...

Want to shortcut your way to real estate riches? Gary Keller’s “The Millionaire Real Estate Investor” is your cheat code. Forget abstract theories; this book...